From Day 1 of system operation, your facility will self-consume solar as it’s being produced, thus relying less on supply, delivery, and ancillary charges from the utility. Because of this, you’ll immediately notice a positive impact on your monthly utility expenses.

The Illinois Shines program provides payments based on system production via SRECs (Solar Renewable Energy Credits). Large commercial installations yield predictable 7-year cash flow with scheduled quarterly receivables, which can sometimes equal up to 40% of the initial investment.

The 30% Investment Tax Credit (ITC) has been a foundational industry accelerant, enabling millions of Americans to adopt solar since 2005. The ITC is available until 2035 and provides a dollar-for-dollar reduction in tax liability for the year placed in service.

Recent provisions for Direct Pay make clean energy credits available to non-tax paying entities such as non-profits, churches, schools, and municipalities. As a result, tax exempt entities can now yield all the benefits of solar ownership vs. 3rd party ownership in previous years.

NOW AVAILABLE Distributed Generation Rebate and Battery Rebate from ComEd. Solar and battery storage systems significantly enhance utility grid stability by smoothing out fluctuations in energy supply and helping to manage peak demand.

Step 1 - Feasibility Check

It's important to understand project particulars early on. That's why our process starts with a remote feasibility check to gauge the opportunities or any hurdles regarding the project. In just a few minutes, we can identify project feasibility by analyzing consumption patterns, checking available PV grid capacity, roof condition or suitable land, while correlating with the site owner’s goals of the project.

With Illinois’ solar policies at their strongest, there’s never been a better time to leverage solar. Ready to learn more? Let’s talk.

"*" indicates required fields

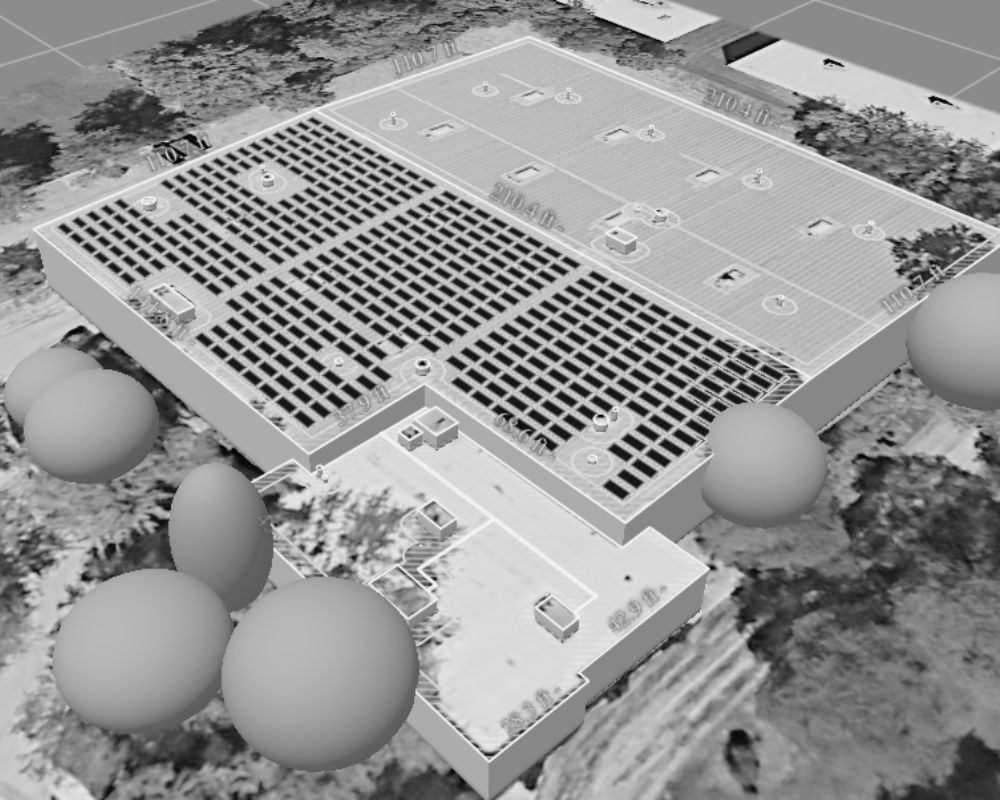

Our process starts with a complementary front-end site analysis, where we gather every crucial detail—energy consumption trends, electrical infrastructure, structural and roofing assessments, irradiance and shade mapping, and even high-precision drone measurements.

Our complimentary onsite audit is essential for streamlining the project development by confirming electrical equipment and specifications, optimizing site model for accurate performance simulations, and minimizing or eliminating change orders during the engineering and permitting phase.

*All ilumen Solar site audits are conducted by licensed Drone Pilots

We use a multitude of tools and processes to accurately develop projects, such as satellite imagery, LIDAR, aerial drone photos & simulated drone measurement flights, and the most advanced solar design software on the market.

Every solar installation is completely custom to fit your needs, so depending on the size, scope, jurisdiction, and complex, project timelines can be variable.

What to Expect:

Once both parties agree to move forward with the project, our team gets to work immediately. Some early stages of onboarding include utility Interconnection Application, Net Metering Application, Permitting & Engineering, and initial stages of Incentive Applications.

Pro Tip:

Submitting an Interconnection Application with the utility prior to onboarding can be helpful with identifying any additional utility interconnection costs that may come up.

What to Expect:

Engineering & Permitting is often the most detailed and time-consuming phase of the entire project. Our engineering team will conduct structural calculations, electrical configurations, and cross reference with applicable code requirements for the AHJ (Authority Having Jurisdiction), typically the village or county where the project is located.

Scheduling a site assessment in the early stages of project development will help streamline this process by eliminating unforeseen project hurdles.

What to Expect:

Once the permit plans are completed and stamped, our team will email all documents for your approval prior to submission. Once approved, we will submit all applicable documents to the AHJ for review and approval. Permit approvals by the AHJ can vary based on size and scope but usually approved within 2-8 weeks.

Pro Tip:

An installation partner well versed in applicable code requirements and local AHJ requirements typically improves permit approval turnaround times.

What to Expect:

As soon as the permit is approved by the AHJ, our team begins preparation of mobilizing the team for installation. Some steps leading up to construction are procurement of any remaining materials, coordinating schedules, and keeping an eye on any pending weather events. Depending on the size and scope of the project, the physical solar installation is usually one of the quickest parts of the project

Pro Tip:

It’s important to communicate any particulars regarding business operation ahead of time so all parties can plan accordingly.

What to Expect:

Once the scope of the project is completed in full, the system cannot be commissioned until formal inspection approval. On the final day of installation, our team will reach out to the AHJ and schedule the final inspection. Depending on the inspector’s schedule, this can sometimes be within a couple days or a couple weeks.

Pro Tip:

It’s important to ensure that all aspects of your facility are up to code when an inspector is onsite to avoid any delays of solar inspection approval.

What to Expect:

Undoubtedly the most exciting part of the entire process is activating the system for production. Prior to doing this, we will need the local utility to grant the project PTO (Permission to Operate) after submitting the final inspection approval letter from the AHJ.

Pro Tip:

Internet connectivity plays a critical role in system monitoring, so prior planning is critical to streamline inverter commissioning and online monitoring access.